Tax-deductible donations to the Co-op

Tax-deductible donations to the Wasatch Food Co-op can be made through our fiscal sponsor, Cooperative Development Services (CDS). If you have any questions or need clarification on any type of donation please contact sburanek@wasatch.coop.

Donations made through our fiscal sponsor CDS are completely tax-deductible to the donor. The Wasatch Food Co-op is allowed to use these donations for any reason, EXCEPT for costs directly attributed to brick-and-mortar costs (e.g., building construction costs or land purchases). This is the most flexible way to donate and is preferred by the co-op! Make your donation by one of the following means:

Ways to Donate

1. Donate by check (TAX-DEDUCTIBLE)

Make checks payable to:

Cooperative Development Fund of CDS

Mail checks to:

Wasatch Cooperative Market, LCA

PO Box 4303

Salt Lake City, UT 84110

2. Donate online at giveMN.org (TAX-DEDUCTIBLE)

Easily and securely make your monthly or single donation online through the website (see below for scrolling to the correct Wasatch Cooperative Market box)

3. Donate stock

Working with the Cooperative Development Fund of CDS as our fiscal sponsor also allows us to accept donations of publicly traded stock.

Please email sburanek@wasatch.coop so we can ensure a smooth process; we will likely need to involve your stock brokerage and use specific forms to direct the transfer of your stock, which will be sold after the transfer, with the proceeds used to support our Co-op.

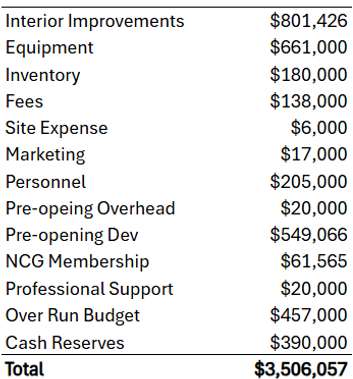

Project budget

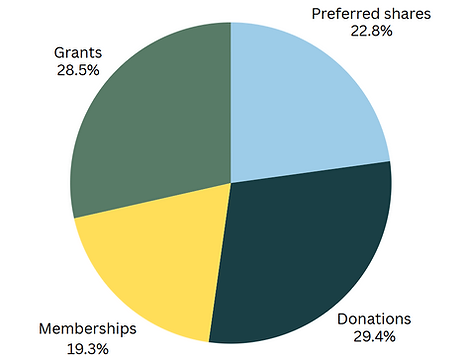

Funding sources

DETAILS OF DONATIONS

Tax-deductible donations to the Wasatch Cooperative Market (DBA Wasatch Food Co-op) must be made through our fiscal sponsor, Cooperative Development Fund of CDS. The Fund meets the requirements for a charitable and educational institution within 501(c)3 federal guidelines and demonstrates compliance by filing annual financial statements (Form 990) with the IRS. The Tax ID of the Cooperative Development Fund of CDS is 39-1540529 seen HERE.

Donations directly to the co-op or CDSUS are not the same as ownership! Charitable gifts DO NOT extend the rights of ownership and therefore no shares, voting rights, owner discounts or any other owner-related benefits are available to the donor.

All donations of $200 and above will be recognized in writing by the Cooperative Development Fund. The Fund will send a written letter of acknowledgment on behalf of the Food Shed Co-op; donors will need such letters for their records should they seek to deduct their gift on their tax returns. Donors of less than $200 will NOT receive a letter, but these donations can be proven by showing a cancelled check or a receipt sent after an online donation.

Donations cannot be returned. Charitable donations made directly to Wasatch Cooperative Market or on our behalf to the “Cooperative Development Fund of CDS” cannot be returned once made. If the board determines the project is no longer feasible, our fiscal agent will use the donated funds to support the wise use of cooperative approaches through education and development.

Use of funds. The mission of the Cooperative Development Fund is to support the wise use of cooperative approaches through education and development. As explained above, donations will be used to facilitate the development of our cooperative. Permitted uses include professional fees, supplies, inventory, employee payroll and benefits, building renovations and furnishings, etc., related to project development. Wasatch Cooperative Market cannot use these funds for actual building supplies, land purchase, or direct construction costs.

Fees associated with charitable donations. Because of the amount of paperwork and back-office work involved in tracking, acknowledging, and releasing funds to cooperatives, there are fees associated with any charitable donation made through our fiscal agent. These fees however serve double-duty since any fees ALSO support the CDS non-profit arm that ultimately allows your charitable donation.

-

For charitable contributions, an administrative fee will be assessed at the rate of 10% of the contributions.

-

For public or foundation grants an administrative fee of 10% of the first $5000 of grant funds plus 5% of funds awarded in excess of $5000.